By Jesse Colombo (This article is frequently updated)

Belgium’s housing bubble is a part of the overall Post-2009 Northern & Western European Housing Bubble that has inflated because of the strong investment inflows that these countries have attracted since the Global Financial Crisis due to their perceived economic safe-haven statuses, serving to further inflate these countries’ preexisting property bubbles that had expanded from the mid-1990s until 2008.

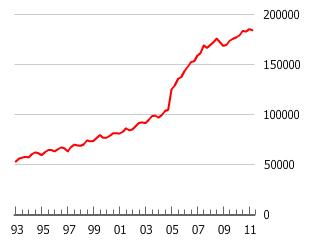

Chart Source: GlobalPropertyGuide.com

Belgium, which is the sixth-largest economy in the euro area and has not had a government in almost two years, has seen its property prices roughly double since the year 2000, barely pausing during the financial crisis in 2009. When property prices hit an all-time high in 2011, The Economist magazine included the Belgian housing market in a list of housing markets that were overvalued by 25% or more according to price-to-income and price-to-rent ratios and described the market as “more overvalued than it was in America at the peak of its bubble.” [1]

Belgian Housing Bubble Articles List

Questions? Comments?

Click on the buttons below to discuss or ask me any question about these bubbles on Twitter or Facebook and I will personally respond: