By Jesse Colombo (This article is frequently updated)

Denmark’s housing bubble is a part of the overall Post-2009 Northern & Western European Housing Bubble that has inflated because of the strong investment inflows that these countries have attracted since the Global Financial Crisis due to their perceived economic safe-haven statuses, serving to further inflate these countries’ preexisting property bubbles that had expanded from the mid-1990s until 2008.

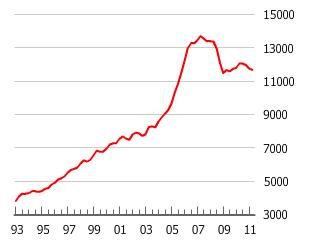

Chart Source: GlobalPropertyGuide.com

Although Danish housing prices have leveled-off after doubling from the late 1990s to 2008, prices are still thoroughly in nosebleed territory and are among the most overvalued in the entire world. Jes Asmussen, chief economist at Svenska Handelsbanken AB, claims that Denmark’s housing market may still be as much as 25 percent overvalued. [1] Denmark’s overleveraged banking system, with banking assets as a percentage of GDP at 454% versus the U.S.’s 90%, will experience unimaginable pain when the country’s housing bubble deflates in earnest. For all of the worry that Greece’s $462 billion sovereign debt has caused the world, Denmark’s ticking-time-bomb mortgage market alone is worth more than $500 billion, with nearly 70% of new mortgages being of the highly-risky adjustable rate variety (ARMs). [2]

Danish Housing Bubble Articles List

Questions? Comments?

Click on the buttons below to discuss or ask me any question about these bubbles on Twitter or Facebook and I will personally respond: