By Jesse Colombo (This article is frequently updated)

The Paris & France housing bubble is a part of the overall Post-2009 Northern & Western European Housing Bubble that has inflated because of the strong investment inflows that these countries have attracted since the Global Financial Crisis due to their perceived economic safe-haven statuses, serving to further inflate these countries’ preexisting property bubbles that had expanded from the mid-1990s until 2008.

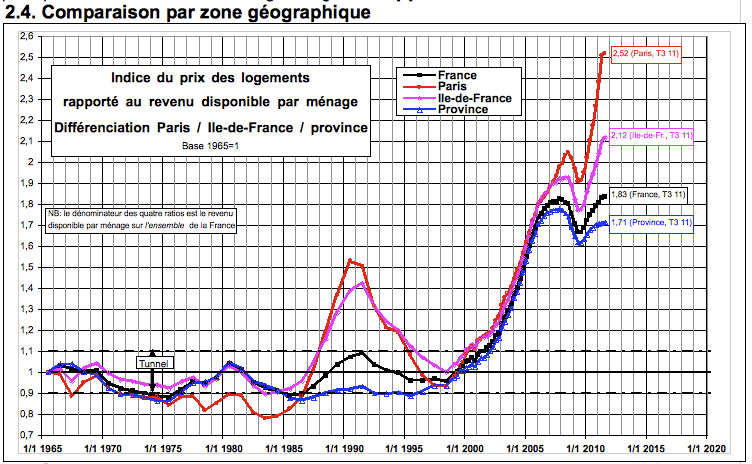

Chart Source: Bulle-Immobiliere.org

After zooming 120% from 2000 to 2008 and briefly dipping 5.6% in 2009, French property prices have continued their inexorable march higher since late 2009. French property prices are highly overvalued, currently valued at 135% of their historic price-to-income ratio and 150% of their historic price-to-rent ratio. [1] Though property prices are strongly rising throughout France, the French housing bubble is largely driven by the Paris region, where prices have jumped 18% in 2010 and approximately 10% in 2011, up more than 40% since 2005. Some posh districts in Paris have risen at a 27% rate in 2011. [2] France’s housing bubble was goosed by a 2009 law that was meant to stimulate the housing market by creating a significant tax incentive for buyers. Mortgage rates that plunged from 6.5% in late 2008 to 3.5% in 2011 were another major  catalyst for soaring property prices, causing fixed-rate mortgage lending to increase by 73% by early 2011. [3]

catalyst for soaring property prices, causing fixed-rate mortgage lending to increase by 73% by early 2011. [3]

The French property market now has the dubious distinction of being the most overvalued in Europe and the third most overvalued market in the world, behind only Hong Kong and Australia [4], which have property bubbles of their own. The Paris-based OECD warned that “there is a risk that a prolonged period of easy finance could result in a price bubble,” which may endanger French banks [5], while Hervé Boulhol, the OECD’s France economist, warned against treating French real estate as a safe-haven and that the property market’s powerful rise without a corresponding rise in income “may signal a bubble phenomenon, as a bubble is a disconnection with fundamentals.” [6] Moody’s also issued a warning that the French property market was overheating and that the least cautious lenders could face steep losses in a more price severe drop. [7] By early 2012, the French property lending boom showed signs of an abrupt slowdown, with new mortgage loans dropping 25.7% in January 2012 (yoy) and a 49.4% drop in loans between December 2011 and January 2012. [8]

French Housing Bubble Articles List

Questions? Comments?

Click on the buttons below to discuss or ask me any question about these bubbles on Twitter or Facebook and I will personally respond: