By Jesse Colombo (This article is frequently updated)

Norway’s housing bubble is a part of the overall Post-2009 Northern & Western European Housing Bubble that has inflated because of the strong investment inflows that these countries have attracted since the Global Financial Crisis due to their perceived economic safe-haven statuses, serving to further inflate these countries’ preexisting property bubbles that had expanded from the mid-1990s until 2008.

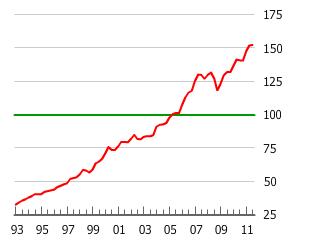

Chart Source: GlobalPropertyGuide.com

Norwegian property prices have tripled since the mid-1990s, up nearly 30% since the Great Recession as the oil-rich nation rode the coattails of the commodities bubble and has benefitted from the same “flight to safety” capital flows that have benefitted (and inflated bubbles in) other Nordic countries. Norwegian property prices are highly overvalued, currently valued at 125% of their historic price-to-income ratio and an incredible 170% of their historic price-to-rent ratio. [1] Norway’s Prime Minister Jens Stoltenberg admitted that he was “afraid” that the Norwegian property bubble might burst [2], while renowned U.S. bubble skeptic Robert Shiller said of Norwegian property prices, “This really does look like a bubble.” [3] and that policy makers “should start worrying now because when the home prices get so high there’s a problem.” The euro area’s crisis has sparked “flight to safety” capital flows into Norway’s highly-desirable investment assets, pushing the Krone currency to undesirable export-harming heights and forcing the country’s central bank to cut interest rates to stem the inflow. Norway’s ballooning housing bubble is a side-effect  of the nation’s excessively low interest rates relative to economic growth and inflation rates.

of the nation’s excessively low interest rates relative to economic growth and inflation rates.

In February 2012, the IMF cut Norway’s growth forecast, saying that the Norwegian housing bubble is the country’s biggest economic risk and threatens everything from banks to economic growth. [4] Norway’s booming housing markets and cheap interest rates are encouraging households to engage in a typical bubble-style debt binge as private debt burdens are estimated to grow to about 204 percent of disposable incomes in 2012. [5] A major risk to Norway’s economy (and possible bubble-popping catalyst) that virtually no mainstream commentators have acknowledged is the very real possibility that oil prices might drop and sharply reduce the country’s oil profits and thus economic growth.

Norwegian Housing Bubble Articles List

Questions? Comments?

Click on the buttons below to discuss or ask me any question about these bubbles on Twitter or Facebook and I will personally respond: