By Jesse Colombo (This article is frequently updated)

Sweden’s housing bubble is a part of the overall Post-2009 Northern & Western European Housing Bubble that has inflated because of the strong investment inflows that these countries have attracted since the Global Financial Crisis due to their perceived economic safe-haven statuses, serving to further inflate these countries’ preexisting property bubbles that had expanded from the mid-1990s until 2008.

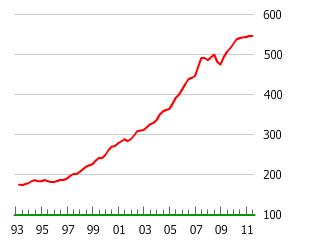

Chart Source: GlobalPropertyGuide.com

In a pattern similar to other Nordic property markets, Swedish property prices have nearly tripled since the mid-1990s and shrugged off the Great Recession woes to rise to incredible new heights. Swedish property prices are overvalued, currently valued at 120% of their historic price-to-income ratio and 140% of their historic price-to-rent ratio. [1] The most recent phase of Sweden’s housing bubble is fueled by mortgage interest rates that have fallen from 6% in August 2008 to a just above 3%, with adjustable rate mortgages falling to under 2%. [2] Tommy Waidelich, the Social Democrats’ economy spokesman, warned that Sweden may have a housing bubble and that "A drop in house prices would hit growth, employment and state finances” and also saying, "If  the reason that the price is high today is only because investors believe that the selling price will be high tomorrow – when ”fundamental” factors do not seem to justify such a price – then a bubble exists.” [3]

the reason that the price is high today is only because investors believe that the selling price will be high tomorrow – when ”fundamental” factors do not seem to justify such a price – then a bubble exists.” [3]

The IMF has also warned of a possible Swedish housing bubble, saying "There is significant risk of a decline in house prices in coming years, even in a relatively benign economic scenario,” [4] while the OECD warned that Swedish housing prices are overvalued by about 30 percent in relation to income. [5] Robert Shiller, the economist who successfully predicted the popping of the Dot-com and U.S. housing bubbles, warned investors against treating Sweden and Norway’s markets as safe-havens as the Nordic region is caught up in asset bubbles that will end with plunging asset prices. [6] A Danish finance minister has even warned Sweden of the risks of its housing bubble, saying, “Do not make the same mistake as we did in Denmark,” [7] referring to the Danish property bubble that has been deflating since 2008.

Swedish Housing Bubble Articles List

Questions? Comments?

Click on the buttons below to discuss or ask me any question about these bubbles on Twitter or Facebook and I will personally respond: